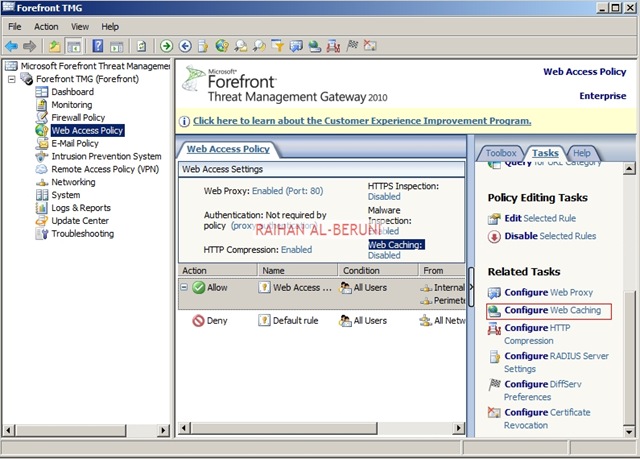

Forefront Tmg 2010 Keygen Generator Download

Learn the skills to be a Architect Learn a new skill online, on your own time. Get started today with video instruction from recognized industry experts.

Microsoft Forefront TMG (Threat Management Gateway) Client is a comprehensive secure web gateway solution that helps to protect employees from web-based threats. Forefront TMG also delivers simple, unified perimeter security, with integrated firewall, VPN, intrusion prevention, malware inspection and URL filtering.

Forefront TMG Client provides HTTPS inspection notifications, automatic discovery, enhanced security, application support, and access control for client computers. It provides authentication for Winsock applications that use TCP and UDP, supports complex secondary protocols, and supplies user and application information to Forefront TMG 2010 logs.

Chinese regulators’ long-running campaign to tame the Wild West of China’s $9.7 trillion third-party payment market reached a milestone as providers moved all of their client funds from separate commercial banks to centrally managed accounts at the central bank. The shift, completed Jan. 14, is part of the government’s crackdown on financial risk and fraud. Regulators ordered payment providers to transfer funds to the special accounts over two years, putting the money under the central bank’s oversight. Game of thrones rpg pdf torrent download. At stake is more than 1 trillion yuan ($149 billion) of customer funds — mostly prepayments for goods and services — that are temporarily held by payment providers before the transactions are cleared. According to the People’s Bank of China, the amount of such funds totaled 1.4 trillion yuan by the end of January, about 90% of it held by the payment services of Alibaba Group-affiliated Ant Financial Service Group and Tencent Holdings.

The absence of unified supervision fueled regulators’ concerns that the money might risk potential misappropriation. The completion of the fund transfer was backed by the launch of China’s first last year. The new clearinghouse, which successfully handled as many as 44,000 transactions each second on Chinese New Year’s Eve Feb. 4, cut the direct link between third-party payment providers and banks and became the nexus connecting more than 200 payment companies with the central bank. Several payment companies including Ant Financial’s Alipay and Tencent’s Tenpay have publicly confirmed that they transferred all customer funds to the designated accounts and closed previous bank accounts used to deposit the money. Payment companies used to open hundreds of accounts under terms negotiated separately with banks to deposit customer funds. Caixin learned that Alipay and Tencent each partnered with more than 100 banks for deposits.

The money was once a lucrative revenue source for payment companies, which could earn interest on cash deposited in banks or even invested in government bonds. Annual interest income on 1 trillion yuan could average more than 10 billion yuan. Under the new rules, payment companies will no longer collect interest after moving customers’ funds to the central bank accounts. Invisible impacts While largely transparent to consumers, the change will have profound effects on the payment industry, analysts said. Major players have been adjusting their business to cope with the lost interest income. Last week, Alipay, the country’s largest payment provider, said it will start charging users for its services to repay credit cards starting in late March. Market speculation has risen recently that Alipay may have booked a net loss in 2018 because of the change.